Should still make real estate investments in Italy?

"In Italy there is a crisis": The most frequent objection is that a potential real estate investor today is this.

It's probably what you think so, and I certainly can not blame you.

Right now difficult historical, It started with the global economic crisis 2007, He has created a mistrust also in respect of 'immobile as a form of investment.

But I want to tell you my thoughts about it and to show the current performance of the property sector another point of view.

Those involved in real estate investments professionally you know that you can continue to invest and make good business also in times of crisis.

Why is this: the house never loses its value. Think carefully, the buildings are of real property to which we will always need.

Maybe change people's needs in terms of properties and investors will have to adapt, but the need of a property will not change.

The decision to buy or rent a home, as deferrable, sooner or later you will still have to be fulfilled.

The real secret per invest in property is, in reality, able to do. A safe and profitable real estate investment is always possible, regardless of how the country's economic situation and industry trends.

The success of a property investment It is in fact capacity investor of generate income with real estate and understand the market needs.

This depends on a few fundamental factors (as choosing the right area and the purchase at a price lower than average) which I'll explain in detail in other articles.

This is not to say that make real estate investments is an activity totally unrelated to the evolution of the market and the economy, it's clear.

I just want you to understand that, by virtue of its particular characteristics, the property is an asset in which should always invest and with whom you may gain, even with the crisis.

provided, naturally, that you know all "rules of the game" to not make mistakes and not scupper the possibility of a profit or, even worse, your capital.

Should invest in real estate today?

As I explained to you my answer is: Yup, should.

should still invest in property not only because the investment property is based on an increasingly requested well, but also because some current data of "negative" market move actually own in favor of those who want to invest.

here 3 Favourable conditions:

-

House prices are low

The fall in prices that has occurred since 2007 onwards will let you today buy a immobile yet cost very more content compared to some years ago.

So as an investor first of all you have the advantage of paying at a cheap price on the property you want to invest.

Furthermore, the presence of a market with very low prices pushes to a greater propensity to buy: potential buyers of your property will be more inclined to buy because they perceive the cost as "an opportunity not to be missed".

Are signs of "crisis" that a expert of real estate investments He is able to transform into "opportunity”: just years and years of experience allow us to know in depth the sector and know how to apply the most effective strategies in each context.

From the graph you can see the drop in house prices in recent years.

Performance index of house prices from 2011 al 2016

Performance index of house prices from 2011 al 2016

-

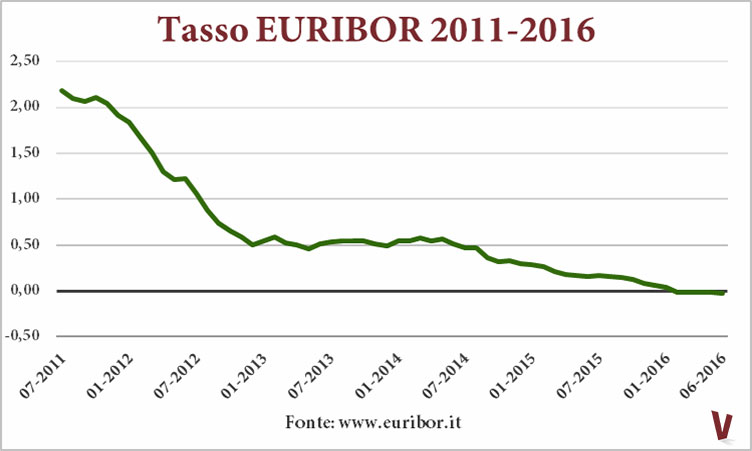

The mortgage rates are at historic lows

At the moment access to credit it is cheaper because interest rates on mortgages are very low and continuing to fall.

This has a double benefit for you: on the one hand allows you to get a mutual a Favourable conditions and on the other also allows the Your potential buyer to enjoy the same facilities.

In the graph you can observe the reduction in interest rates on mortgages have fallen over recent years.

Performance of typical reference rate of mortgage loans from 2011 al 2016

Performance of typical reference rate of mortgage loans from 2011 al 2016

-

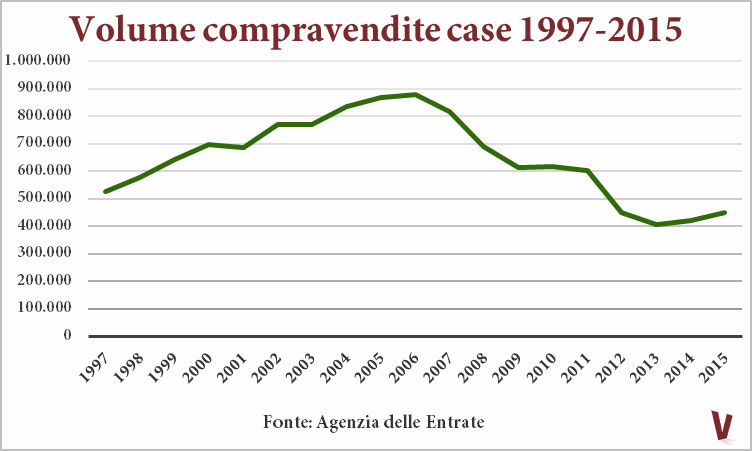

The housing market is rebounding

Here are the most significant: of the market trades is up from 2014.

In first quarter of the 2017 There has been an increase in the +8,6% compared to the same period of 2016.

This figure we can read it as a confirmation of the positive trend and a symptom of renewed confidence from Italian in brick.

Furthermore, more than half of the trade takes place in residential sector.

After a long decline that lasted nearly a decade, then, we can finally talk about a improvement in the housing market.

In the graph you can see the decline started in the 2007, but also the resumption of trade initiated in recent years, in particular from 2014.

Volume Trend of sales of property from 1997 al 2015

Volume Trend of sales of property from 1997 al 2015

With these three data on the housing market I want you to understand that not only can invest despite crisis, but that can be cheaper do it now.

To prove they are also positive statistics on real estate investments in Italy, Studies prepared by Tecnocasa: in the second half of 2016 the 18,6% from shopping property was carried out by investors with the aim of make income.

L’immobile It has always one of the best investments and will remain so.

If you know exactly how to move you do not need to wait for a different market trend: this is the real secret that allows you to invest in any time historical, reducing minimizing risks and obtaining a high gain.

If you want to take advantage of this favorable moment to make an investment property contact us for a free consultation, We deepen solutions To make grow as much as possible your capital with the lowest risk.